best buy 401k withdrawal

Open an Account Today. The IRS typically withholds 20 of.

How Much To Save For Retirement Are You On Track Infographic Finance Infographic Budgeting Money Budgeting

Small business 401 k plans are specifically made for small businesses and we have a list of the best 401 k plans to meet your needs.

. Enter username and password to access your secure Voya Financial account for retirement insurance and investments. Rachel Hartman April 7 2021. Ad Experienced Support Exceptional Value Award-Winning Education.

If at some point you get a check from the broker Is Best Buy still. Withdrawing from a 401k in retirement. I need emergency funds.

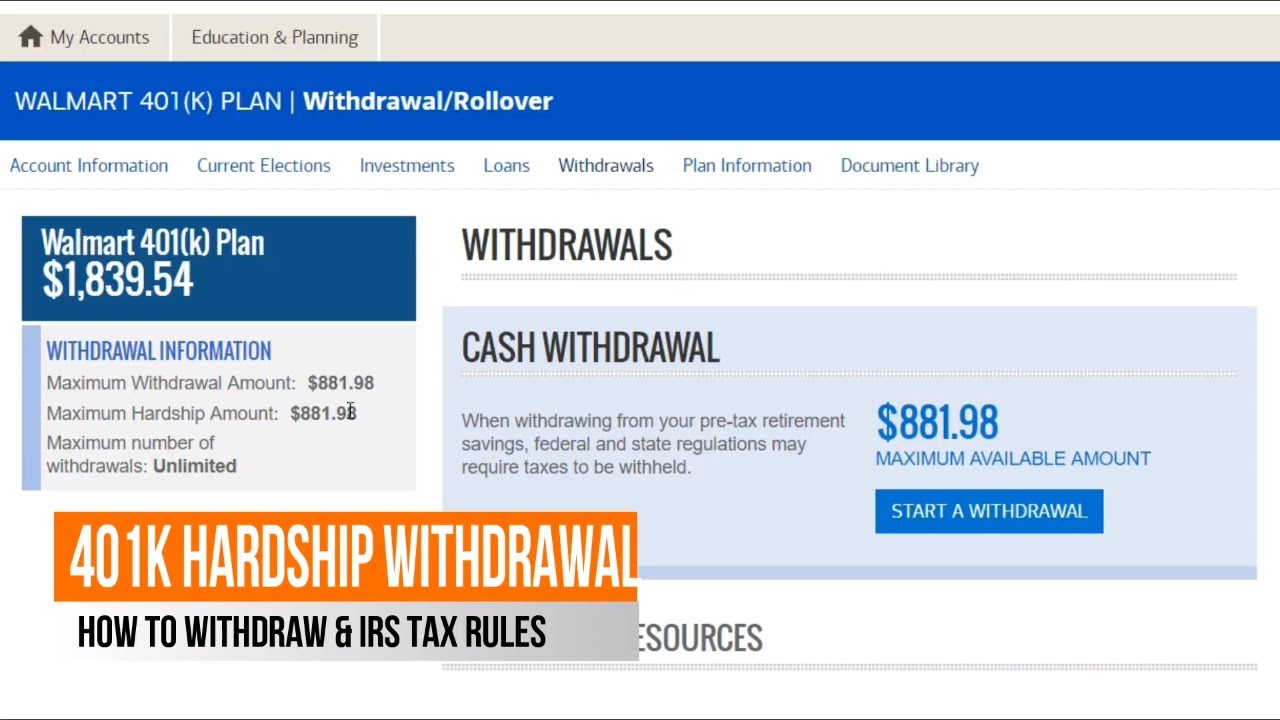

All distributions are subject to ordinary income. Withdraw funds in years. Best buy 401k withdrawal 401k Withdrawal Rules For Home Purchases 2021.

Available to US-based employees Change location. 1698 employees reported this benefit. Best Buy 401K Plan.

About one-third of all 401 k plans. Take required minimum distributions to avoid penalties. Ad If you have a 500000 portfolio download your free copy of this guide now.

Under the IRS 401k withdrawal rules investors can begin making withdrawals after they turn 59 ½. People do this for many. Best for low operating costs.

Removing funds from your 401 k before you retire because of an immediate and heavy. Just seeing if anyone has pulled from their 401K during the pandemic. TD Ameritrade Offers IRA Plans With Flexible Contribution Options.

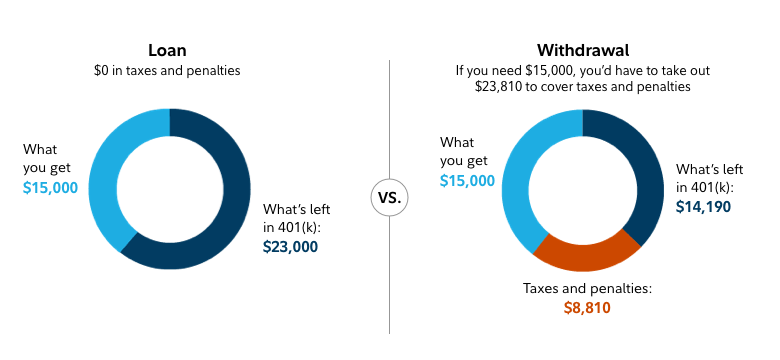

Consider these retirement account withdrawal strategies. If your companys 401 k allows periodic withdrawals ask about transaction fees particularly if you plan to withdraw money frequently. You can roll over the funds from your Best Buy 401k into the new employers plan and effectively pay no penalty.

Best buy 401k withdrawal 401k Withdrawal Rules For Home Purchases 2021 When Is It Ok To Withdraw Money Early From Your 401k. I know BBY setup some special provisions for financial hardship and such. This guide may be especially helpful for those with over 500K portfolios.

Removing funds from your 401 k before you retire because of an immediate and heavy financial need is called a hardship withdrawal. Did you just have to.

How To Withdraw Early From A 401 K Nextadvisor With Time

How To Withdraw From 401k Or Ira For The Down Payment On A House Mortgage Loans Reverse Mortgage Refinance Loans

401 K Hardship Withdrawal Seeking Alpha

Hardship 401 K Withdrawal Qualifications Taxes Ira Financial Group

How 401 K Tax On Withdrawals Can Hurt Your Finances Credit Karma

401 K Early Withdrawal Overview Penalties Fees

401k Plan Loan And Withdrawal 401khelpcenter Com

Should I Close My 401k Withdraw Retirement Savings

Cares Act 401k Withdrawal Edward Jones

The Cares Act Makes It Easier To Withdraw From Your 401 K Money

401 K Withdrawals What Know Before Making One Ally

Walmart 401k Hardship Withdrawal With Merrill Lynch Irs Tax Rules Crd Distributions April 20 Youtube

Borrow From Your 401k Without Penalty Nextadvisor With Time

Early 401k Withdrawal Explained Your Aaa Network

How To Buy Solana In 2022 Investing Forbes Best Investments

How Much Will I Get If I Cash Out My 401 K Early Ubiquity

Can First Time Home Buyers Use 401 K To Fund The Purchase Oberer Homes